How to Void a Check Correctly Every Time in 2025 – FangWallet

This article may contain references to products or services from one or more of our advertisers or partners. We may receive compensation when you click on links to those products or services. Nonetheless, our opinions are our own.

Key Highlights

- To void a check, write “VOID” in bold, large letters across the front. This ensures it cannot be used fraudulently.

- Voiding a check is necessary to set up direct deposits, automatic bill payments, or securely share banking information.

- Always use black or blue ink and ensure “VOID” is visible. Keep a copy for your records before disposing of the original.

- Despite the rise of digital banking, situations requiring avoided check still arise.

- If you don’t have physical checks, banks offer alternatives, such as counter checks or digital check images.

Introduction

Knowing how to void a check is a valuable skill. Whether you’re setting up direct deposit for your paycheck or authorizing automatic bill payments, a voided check serves as a secure way to provide your bank account information. Learning this simple yet essential task helps you safeguard your finances and ensure seamless transactions.

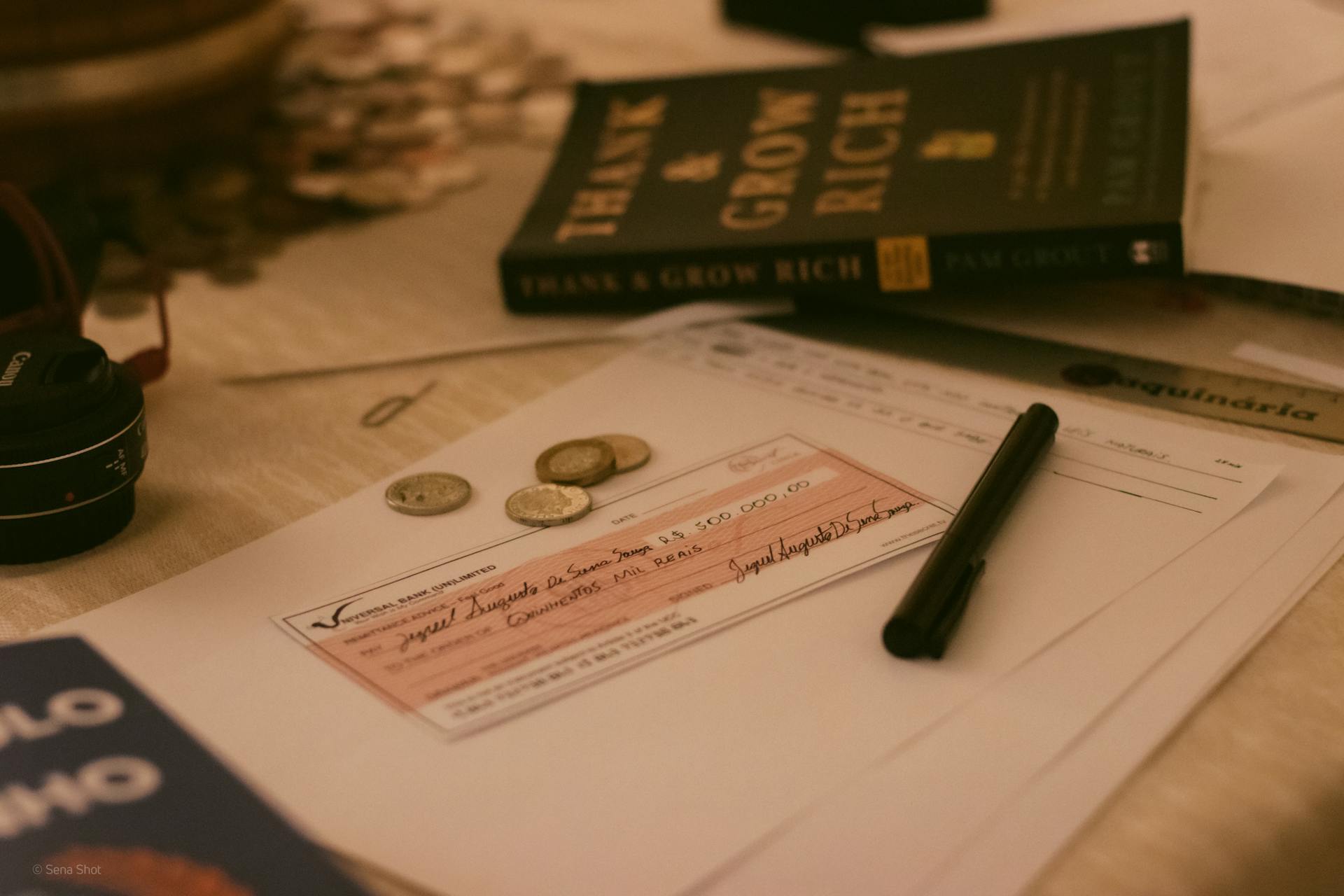

Understanding the Basics of a Check

A check is a paper tool that directs your bank to transfer funds from your account to another person or entity. While many people now rely on digital payments, checks remain relevant for specific purposes, such as direct deposits.

Every check includes critical information:

- Routing Number: A nine-digit code identifying your bank.

- Account Number: Your unique bank account identifier.

These details are located at the bottom of the check and are vital for accurate financial transactions.

The Anatomy of a Check

A check contains:

- Payee Information: The recipient’s name.

- Date: When the check is issued.

- Amount: The value to be paid.

- Signature: Your authorization.

While the routing and account numbers are necessary for banking purposes, they must be kept secure to prevent unauthorized access to your funds.

Why Knowing How to Void a Check is Essential

Voiding a check renders it unusable for financial transactions while still displaying your banking details. It’s frequently required for:

- Setting Up Direct Deposits: Employers may need a voided check to deposit wages directly into your account.

- Automatic Payments: Utilities, subscriptions, or other recurring bills often require your account information.

- Fixing Errors: A voided check can replace one with incorrect details, ensuring no unauthorized or mistaken use.

By voiding a check, you protect your account while sharing essential details securely.

Preparing to Void a Check

Before voiding a check, ensure you have the following:

- Correct Check: Verify you’re using the intended check, as a voided check cannot be reused.

- Black or Blue Ink Pen: These colors are durable and professional. Avoid lighter inks that might fade or appear illegible.

Step-by-Step Guide to Voiding a Check

- Write “VOID” Across the Check

- Use a black or blue pen.

- Write “VOID” clearly in large, bold letters across the check’s front.

- Avoid obscuring the routing and account numbers—they are often needed for direct deposits or payments.

- Do not sign or fill out other fields on the check, as this can cause confusion.

- Record the Voided Check

- Log the voided check in your check register for future reference.

- Include the check number, the reason for voiding it, and the date.

- Dispose of Safely (if necessary)

- Shred the voided check to prevent unauthorized access to your banking information.

Reasons to Void a Check

- Direct Deposits and Automatic Payments: Voided checks are required to provide accurate banking details.

- Correcting Errors: If a mistake occurs (e.g., wrong amount or payee), void the check to prevent misuse.

- Duplicate Checks: If you notice duplicate entries, void one to avoid confusion.

FAQs

May I Void a Check Already Sent?

No, but you can request a “stop payment” from your bank. Provide the check number, date, and amount. Be aware of potential fees.

What If I Don’t Have Physical Checks?

Banks can provide alternatives, such as counter checks or official forms, that function as voided checks.

Is Voiding a Check the Same as Canceling It?

No. Voiding prevents a check from being used, while canceling stops a sent check from processing.

What Should I Do With a Voided Check?

Shred or securely dispose of it to prevent misuse of your banking information.

Can I Void a Check for Any Reason?

Yes, voiding ensures proper account protection, whether for setting up payments, fixing errors, or securely sharing account details.

Conclusion

Knowing how to void a check is a small but essential financial skill. It enables secure transactions, prevents errors, and protects your account from misuse. Following these straightforward steps, you can confidently handle any situation requiring a voided check. Stay informed, act carefully, and safeguard your finances.

Reviewed and edited by Albert Fang.

See a typo or want to suggest an edit/revision to the content? Use the comment form below for feedback.

At FangWallet, we value editorial integrity and open collaboration in curating quality content for readers to enjoy. Much appreciated for the assist.

Did you like our article and find it insightful? We encourage sharing the article link with family and friends to benefit as well – better yet, sharing on social media. Thank you for the support! 🍉

Article Title: How to Void a Check Correctly Every Time in 2025

https://fangwallet.com/2024/12/05/how-to-void-a-check/The FangWallet Promise

FangWallet is an editorially independent resource – founded on breaking down challenging financial concepts for anyone to understand since 2014. While we adhere to editorial integrity, note that this post may contain references to products from our partners.

The FangWallet promise is always to have your best interest in mind and be transparent and honest about the financial picture.

Become an Insider

Editorial Disclaimer: The editorial content on this page is not provided by any of the companies mentioned. The opinions expressed here are the author’s alone.

The content of this website is for informational purposes only and does not represent investment advice, or an offer or solicitation to buy or sell any security, investment, or product. Investors are encouraged to do their own due diligence, and, if necessary, consult professional advising before making any investment decisions. Investing involves a high degree of risk, and financial losses may occur including the potential loss of principal.

Advertiser Disclosure: This article may contain references to products or services from one or more of our advertisers or partners. We may receive compensation when you click on links to those products or services.

Source: How to Void a Check Correctly Every Time in 2025 – FangWallet